1. What is GSTR-8?

GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct TCS (Tax collected at source) under GST. GSTR-8 contains the details of supplies effected through e-commerce platform and amount of TCS collected on such supplies.

2. Who should file GSTR-8?

Every e-commerce operator registered under GST is required to file GSTR-8. E-commerce operator has been defined under GST Act as any person who owns or manages a digital or electronic facility or platform for electronic commerce such as Amazon etc. All such e-commerce operators are mandatory required to obtain GST registration as well as registered for TCS (Tax collection at source).

3. Who classifies as an e-commerce operator?

E-commerce operator is any person who owns or manages the digital or electronic facility or platform for electronic commerce such as Amazon, Flipkart, etc. The e-commerce operator provides a platform whereby the sellers can reach out to a large number of customers by getting registered online on their platform. Customers also get benefits as they get access to multiple sellers and competitive prices for the desired product.

4. Why is GSTR-8 important?

GSTR-8 shows the details of supplies effected through the e-commerce platform and the amount of TCS collected on such supplies. Currently, the Government has put the TCS provisions on hold. It is going to be applicable from 1st Oct 2018 onwards. In case of TCS being applicable, the supplier can take the input credit of such TCS deducted by the e-commerce operator after filing of GSTR-8 by the e-commerce operator. The amount of such TCS will be reflected in Part C of Form GSTR-2A of the supplier.

For instance, consider that Shanta Enterprises supplies garments worth Rs 20,000 through Amazon. Now Amazon being the e-commerce operator will deduct the TCS @ 1% and deposit Rs 200 with the Government. The amount of Rs 200 will get reflected in GSTR-2A of Shanta Enterprises after filing of GSTR-8 by Amazon.

5. When is GSTR-8 due?

GSTR-8 filing for a month is due on 10th of the following month. For instance, the due date for GSTR-8 for October is on the 10th of November.

6. What is the penalty for not filing GSTR-8 within the due date?

If the GST return is not filed on time, then a penalty of Rs 100 under CGST & Rs 100 under SGST shall be levied per day. The total will be Rs. 200/day. The maximum is Rs. 5,000. There is no late fee on IGST in case of delayed filing.

Along with late fee, interest at 18% per annum has to be paid. It has to be calculated by the taxpayer on the tax to be paid. The time period will be from the next day of filing to the date of payment.

7. How to revise GSTR-8?

GSTR-8 once filed, cannot be revised. Any mistake made in the return can be revised in the next month’s return. It means that if a mistake is made in October GSTR-8, rectification for the same can be made in November GSTR-8 or in later months when the error or omission is identified.

8. Details to be provided in GSTR-8

GSTR-8 has a total of 9 sections:

1. Provide GSTIN (provisional id can also be used as GSTIN if you do not have a GSTIN)

2. Legal name of the registered person: Name of the taxpayer will be auto-populated at the time of logging into the common GST Portal.

3. Details of supplies made through e-commerce operator: Mention the gross value of supplies made to registered persons and unregistered persons and value of supplies returned by such registered and unregistered persons.The difference between the supplies made and supplies returned will be the net amount liable for TCS.

4. Amendments to details of supplies in respect of any earlier statement: Any correction to data submitted in the return of previous months can be done by filling in this section.

5. Details of interest: If the amount of TCS is not paid on time by the e-commerce operator, then interest is levied on account of late payment of TCS amount.

6. Tax payable and paid: This head includes the total amount of tax payable under each head i.e SGST, CGST and IGST and how much tax has been paid till date.

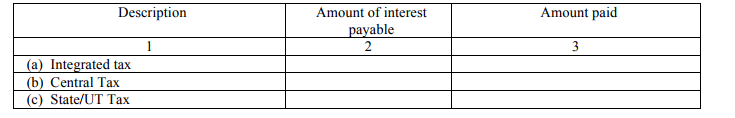

7. Interest payable and paid: Interest @ 18% is levied for the late payment of GST.The interest is calculated on the outstanding tax amount

8. Refund claimed from electronic cash ledger: Refund from electronic cash ledger can only be claimed only when all the TCS liability for that tax period has been discharged.

9. Debit entries in cash ledger for TCS/interest payment [to be populated after payment of tax and submissions of return: Amount of tax collected at source will flow to Part C of GSTR-2A of the taxpayer on filing of GSTR-8

Comments

Post a Comment